Unfortunately, the Keystone State’s economic climate is honestly not much better than California’s. Our corporate tax rate is the third-highest in the country, and Gov. Tom Wolf’s budget proposals constantly threaten to raise taxes on small employers, energy companies and middle-class families. These polices not only fail to attract jobs and investment to Pennsylvania, but also have led to losing jobs here.

How can we expect to attract entrepreneurs from other states today when we are just three weeks removed from our governor calling for a 46 percent income tax increase on small employers and an energy tax that chases investment away from our communities? The unilateral carbon tax created by the governor as part of the Regional Greenhouse Gas Initiative only makes the situation worse.

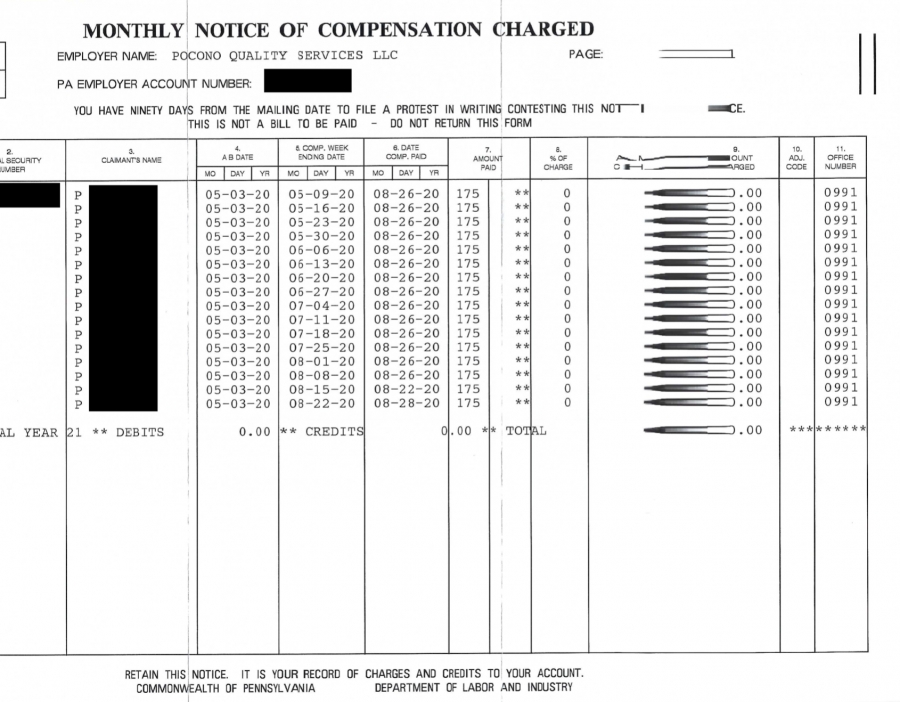

Our state’s response to COVID-19 was similarly terrible for most employers. The data show that Gov. Wolf closed too many employers in too many industries, and kept those businesses closed for too long. The latest employment figures demonstrate the economic devastation; from December 2019 to December 2020, Pennsylvania lost an estimated 370,000 jobs.

If we want to help our communities recover from COVID-19 and create an environment for job growth, we must work with our employers to support healthy economic policies, instead of allowing existing state policy and stubborn ideology to work against them.

Rather than accepting our current state of mediocrity and allowing us to languish among the worst business tax climates in the country, we should position our commonwealth as a place of opportunity that creates quality jobs and remains a great place to live, learn, work and play. That means pursuing pro-growth policies that will send a strong message that Pennsylvania is open for business.

My colleagues and I have introduced several bills to accomplish these goals, including a bill I proposed to ban discriminatory project labor agreements; small business assistance measures proposed by Sen. Ryan Aument; enacting small business reforms including like kind exchanges, net operating loss deductions and expense deductions; addressing the growing regulatory burdens and permitting process delays that create obstacles to economic growth; and providing immediate tax relief to businesses suffering as a result of the pandemic.

These bills and other employer-friendly tax and regulatory reforms could pave the way for Pennsylvania to emerge from COVID-19 stronger than ever before. Confronting these challenges now will not be easy, but it is critical to ensure our Commonwealth reaches its fullest potential, to grow and create more family-sustaining jobs and ensure we do not become another California.

[Source]