“It’s past time to allow the people of Pennsylvania to directly decide the future of school property tax elimination,” DiSanto said. “Our proposal outright prohibits school districts from levying property taxes and ensures the powerful and entrenched special interests opposing reform would no longer be able to block needed action.”

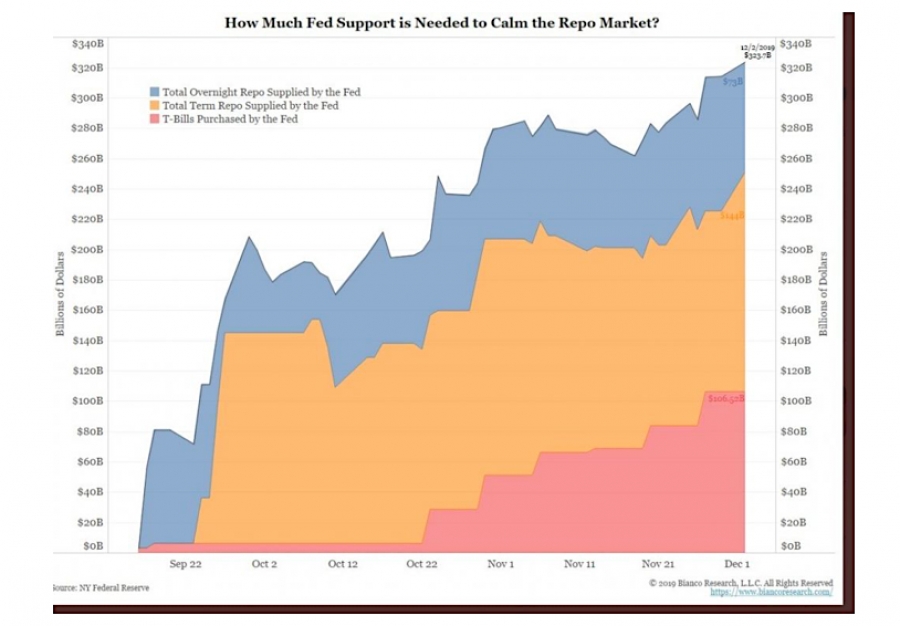

The Independent Fiscal Office estimates districts collected $15.1 billion in tax revenue in the current year. That figure will climb to $15.7 billion through 2022.

Critics argue the regressive tax system create disparities in education, particularly for low income neighborhoods and students of color.

Residents living on fixed incomes likewise struggle to afford their homes as rates climb. A WalletHub analysis concludes a tax bill on a property priced at the state median of $180,200 is $2,852, ranking Pennsylvania ninth in the nation for its tax burden on homeowners.

“Constituents in our districts and across the entire Commonwealth are suffering greatly under the weight of constantly increasing school property taxes,” Stambaugh said. “The status quo is unacceptable, and voter approval of this constitutional amendment would force the General Assembly to address this issue once and for all.”

The Senate rejected a proposal to eliminate all property taxes as recently as 2015. But a constitutional amendment, DiSanto said, would force the Legislature to act.

In 2017, voters also approved a constitutional amendment that expands the homestead exclusion’s value to 100% of a property’s assessed value – and eliminating the taxes altogether is something the General Assembly has considered for decades.

(source)