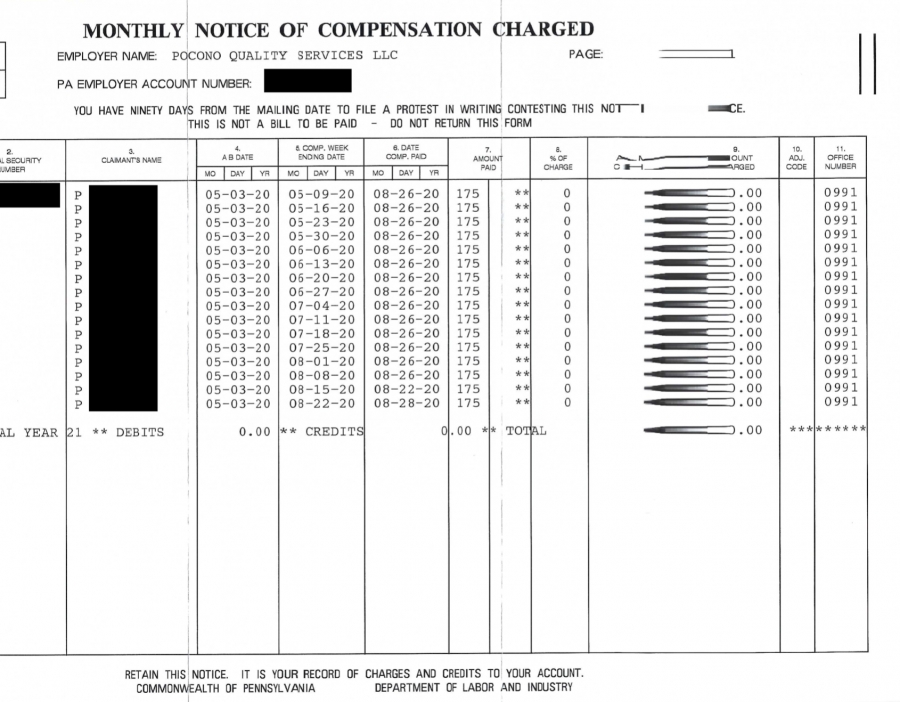

1. It forces an unnecessary burden on employers, meaning business owners are likely to headquarter their business elsewhere:

(Page 6)

A. Each Employer within the Township, as well as those Employers situated outside

the Township but who engage in business within the Township, is hereby charged with the duty of collecting the Tax from each of his employees engaged by him or performing for him within the Township and making a return and payment thereof to the Collector.

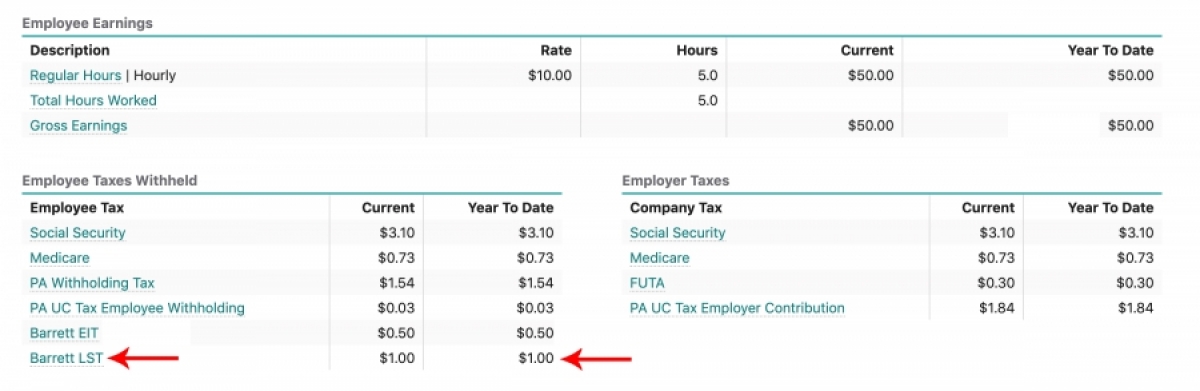

2. While making it less attractive for people to work for employers in Barrett (because they could earn $52/year more by working the same job for the same pay somewhere else).

(Page 1)

WHICH SHALL DE IMPOSED AT THE RATE OF FIFTY TWO ($52.00) DOLLARS PER YEAR, ON THE PRIVILEGE OF ENGAGING lN AN OCCUPATION WITHIN THE LIMITS OF BARRETT TOWNSHIP;

3. This ordinance also makes it less attractive for contractors from outside of Barrett to work for homeowners in Barrett because they technically need to file the corresponding LST form and pay the tax.

(Page 8)

SECTION 11. NONRESIDENTS SUBJECT TO TAX.

All Employers and self-employed Individuals residing or having their places of business outside of the Township but who perform services of any type or kind or engage in any Occupation or profession within the Township do, by virtue thereof, agree to be bound by and subject themselves to the provisions, penalties and regulations promulgated under this Ordinance with the same force and effect as though they were residents of the Township. Further, any Individual engaged in an Occupation within the Township and an employee of a nonresidential Employer may, for the purpose of this Ordinance, be considered a self-employed person, and in the event his or her Tax is not paid, the Township shall have the option of proceeding against either the Employer or employee for the collection of this Tax as hereinafter provided.